Your blueprint to transform a cheap house in Japan into an incredible investment.

Your first akiya awaits…

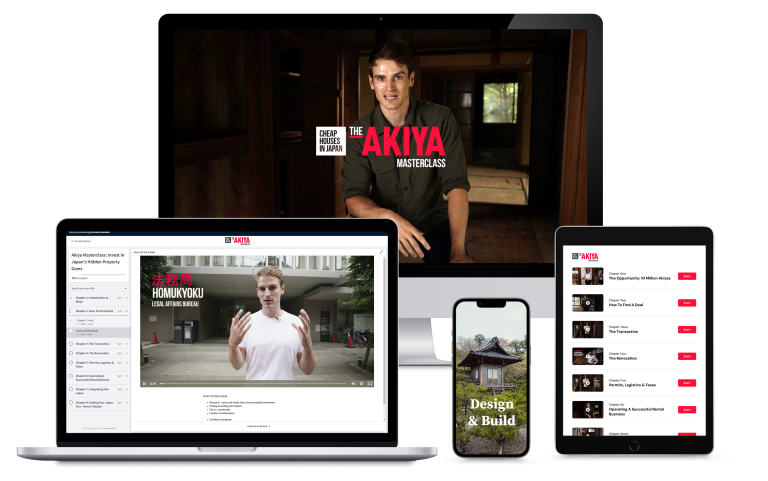

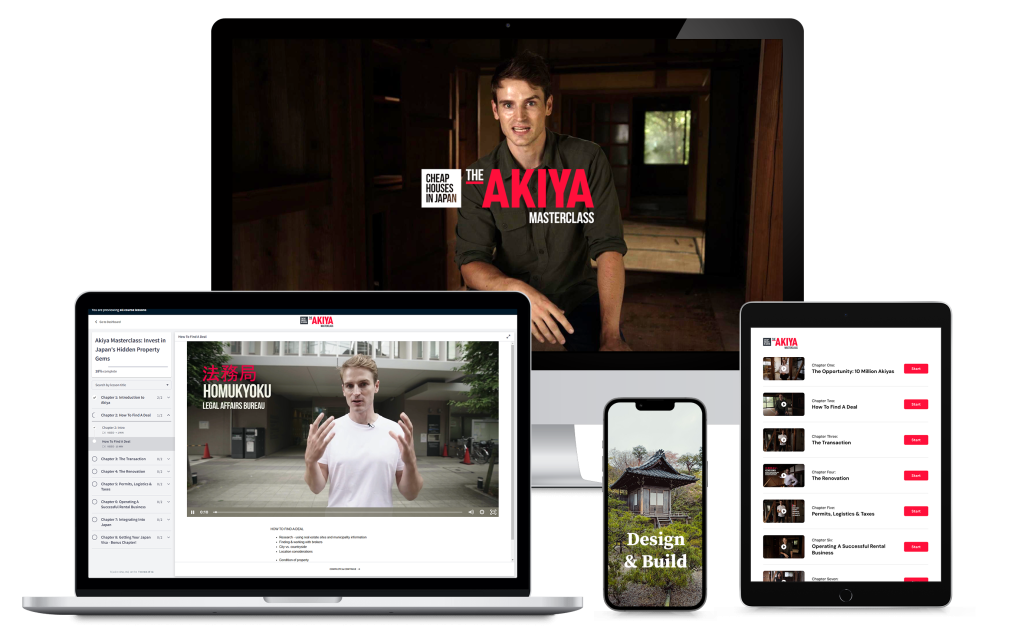

Introducing:

CHEAP HOUSES IN JAPAN: The Akiya Masterclass

8 Packed Episodes

Actionable instruction to fast track your learning + 6 step-by-step tasks to buy your first akiya and be on your way to profitable properties in Japan!

Broker List & Email Templates

My list of reputable brokers in Japan’s best cities for akiya investment + email templates that’ll motivate them to find you great deals.

Renovation Budgeter Tool

The budget planning template I use to project my renovation costs & calculate expected profits before I make offers.

Lifetime access

Enjoy lifetime access to the masterclass + tools, and receive all my upcoming expansion lessons, updated materials and new tools, FREE!

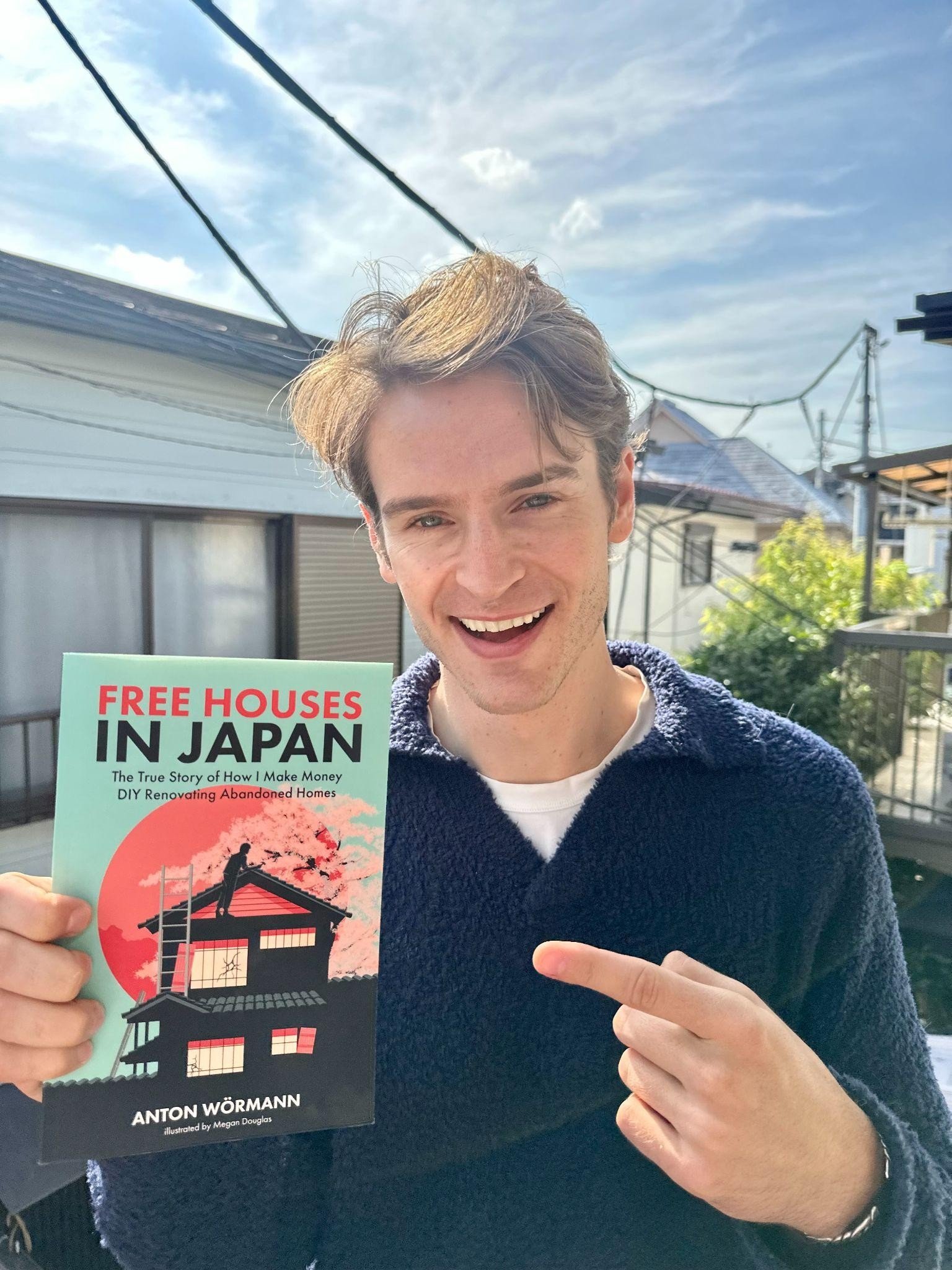

Hi, I’m Anton Wörmann — akiya (abandoned Japanese home) investor, author, & YouTuber.

My first year in Japan, I bought and renovated an akiya.

When I launched a YouTube channel about my Japan home renovation projects, my first video went viral (30 million views). In 4 months, I had 400,000 followers, and it was clear that people around the world love akiyas.

Today, my 5 renovated akiyas (more finishing soon!) are rented at 100% occupancy, some short term ($120k – $180k/year) and some long term. And several are generating 100% ROI (my full purchase and renovation cost earned back in just the first year).

As Japan tourism smashes new records, the enormous demand for beautiful home rentals continues growing rapidly.

With 10 million+ abandoned houses in Japan, we’re in the path of two major trends intersecting to produce one of the most exciting opportunities in real estate.

I hope you’ll join me on this journey – when foreigners buy and rent akiyas the right way, it makes us all look good.

Hi, I’m Nick Lange,

real estate investor & video maker.

8 years ago, I bought my first house in LA. It was wildly overpriced. But I was excited and proud to be a homeowner. I started renting spare bedrooms out to cover the mortgage. Then I refinanced that house to buy another house in LA, a bigger one that, after renovation, I knew could generate good profit through this co-living rental model.

I’ve repeated this process every year since, and today, I have 48 tenants in 8 properties. My plan was to continue refinancing, buying, renovating, and renting in the U.S. Then I met Anton Wörmann.

Everything about real estate in the U.S. became less exciting as I learned that there are 10 million beautiful, well-built, abandoned houses in Japan, many of which can become very profitable short-term rentals as tourism skyrockets in Japan (15% tourism growth YOY, with 36 million tourists in 2024 and far beyond that projected for 2025).

Anton wants to grow the community of foreign investors here – for some reason, he likes us – and he believes Japan needs an influx of new homeowners to solve the problems of a declining population.

My other career is producing videos about interesting things for clients like NASM, Nike, and Sony, so I offered to help him accomplish his goal with interesting videos that would document every aspect of his brilliantly effective process — something I happened to need as an aspiring akiya investor.

I hope to meet you (and maybe even live next to you) here in Japan soon.

Hi, I’m Anton Wörmann — akiya (abandoned Japanese home) investor, author, and YouTuber.

My first year in Japan, I bought and renovated an akiya.

When I launched a YouTube channel about my Japan home renovation projects, my first video went viral (30 million views). In 4 months, I had 400,000 followers, and it was clear that people around the world love akiyas.

Today, my 5 renovated akiyas (more finishing soon!) are rented at 100% occupancy, some short term ($120k – $180k/year) and some long term. And several are generating 100% ROI (my full purchase and renovation cost earned back in just the first year).

As Japan tourism smashes new records, the enormous demand for beautiful home rentals continues growing rapidly.

With 10 million+ abandoned houses in Japan, we’re in the path of two major trends intersecting to produce one of the most exciting opportunities in real estate.

I hope you’ll join me on this journey – when foreigners buy and rent akiyas the right way, it makes us all look good.

Hi, I’m Nick Lange, real estate investor & video maker.

8 years ago, I bought my first house in LA. It was wildly overpriced. But I was excited and proud to be a homeowner. I started renting spare bedrooms out to cover the mortgage. Then I refinanced that house to buy another house in LA, a bigger one that, after renovation, I knew could generate good profit through this co-living rental model.

I’ve repeated this process every year since, and today, I have 48 tenants in 8 properties. My plan was to continue refinancing, buying, renovating, and renting in the U.S. Then I met Anton Wörmann.

Everything about real estate in the U.S. became less exciting as I learned that there are 10 million beautiful, well-built, abandoned houses in Japan, many of which can become very profitable short-term rentals as tourism skyrockets in Japan (15% tourism growth YOY, with 36 million tourists in 2024 and far beyond that projected for 2025).

Anton wants to grow the community of foreign investors here – for some reason, he likes us – and he believes Japan needs an influx of new homeowners to solve the problems of a declining population.

My other career is producing videos about interesting things for clients like NASM, Nike, and Sony, so I offered to help him accomplish his goal with interesting videos that would document every aspect of his brilliantly effective process — something I happened to need as an aspiring akiya investor.

I hope to meet you (and maybe even live next to you) here in Japan soon.

How does this sound?

By the end of this course you’ll…

⌂

Develop a comprehensive understanding of the Japanese real estate market, with a focus on the akiya (abandoned traditional Japansese home) sector.

⌂

Learn the skills to effectively search for and identify akiya properties that align with your investment objectives.

⌂

Gain the knowledge and confidence to make well-informed purchasing decisions based on research and risk assessment.

⌂

Develop a robust strategy for renovation projects, through cost-effective planning, execution, and management.

⌂

Acquire valuable insights into successful renovation techniques, common mistakes, and strategies for mitigating risk.

⌂

Explore a range of investment strategies, including short-term rentals, long-term rentals.

How does this sound?

By the end of this course, you'll...

⌂

Develop a comprehensive understanding of the Japanese real estate market, with a focus on the akiya (abandoned traditional Japansese home) sector.

⌂

Learn the skills to effectively search for and identify akiya properties that align with your investment objectives.

⌂

Gain the knowledge and confidence to make well-informed purchasing decisions based on research and risk assessment.

⌂

Develop a robust strategy for renovation projects, through cost-effective planning, execution, and management.

⌂

Acquire valuable insights into successful renovation techniques, common mistakes, and strategies for mitigating risk.

⌂

Explore a range of investment strategies, including short-term rentals, long-term rentals.

Chapter One:

The Opportunity: 10 Million Akiyas

List of Lessons

THE OPPORTUNITY: 10 MILLION AKIYAS

- The Akiya Market

- Reimagining an Akiya

- The Lure of the Akiya Market

- Why an Akiyas are a Unique Opportunity

Chapter Two:

How To Find A Deal

List of Lessons

HOW TO FIND A DEAL

- Research with Real Estate Sites & Municipality Sites

- Finding & Working With Brokers

- City vs. Countryside

- Location Considerations

- Condition of Property

Chapter Three:

The Transaction

List of Lessons

THE TRANSACTION

- The Buying Process

- Making an offer, Negotiating & Completing a Purchase

- Seller Psychology in Japan

Chapter Four:

The Renovation

List of Lessons

THE RENOVATION

- Carpentry

- Demolition

- The Bedroom

- Finding Inspiration

- The Architecture of Renovation

- Budgeting

Chapter Five:

Permits, Logistics & Taxes

List of Lessons

PERMITS LOGISTICS & TAXES

- Moving Costs & Process

- The Deposit

- Phone, Internet & Utilities

Chapter Six:

Operating A Successful Rental Business

List of Lessons

OPERATING A SUCCESSFUL RENTAL BUSINESS

- Planning for Problems That Can Arise

- Long Term vs. Short Term Rentals

- Property Management

- Rules

Chapter Seven:

Integrating Into Japan

List of Lessons

INTERGRATION IN TO JAPAN

- Being Accepted

- Words to Know

- Formal vs. Casual Japanese

- Making Friends

- Japanese Humor

Chapter Eight (Bonus Chapter):

Getting Your Japan Visa

List of Lessons

GETTING YOUR JAPAN VISA

- The Most Popular Visas for Foreign Akiya Investors

- The Application Process

- Costs & Timeliness To Expect

- Mistakes To Avoid

Learn from the best in Japan

To master the fundamentals you’ll need, I've brought together some of my favorite experts teaching the skills every foreign akiya investor should have:

Naomi Saito

Airbnb Owner & Akiya Investor

Teaches: Long Term Rental Strategy

Erik Nasriddinov

CEO of E-Housing

Teaches: Broker Insights

Shotaro Fujisawa

Co-Founder and CEO Yamori Inc.

Teaches: Akiya Investment Insights

Valerie Vyvial

Architect/Co-Founder &

Director at Vyvial Suzuki Studios

Teaches: Renovation in Japan

Mr. Inoue

Visa Officer

Teaches: Visas for Foreign Investors

Ananya Donapati

Japanese Language Teacher & Content Creator

Teaches: Learning Japanese Language & Culture

A few of our success stories…

Sangenjaya House

Owner: Me

Location:

Setagaya, Tokyo

Purchase Price:

8 million yen (~$51,400 USD)

Renovation Cost:

8 million yen (~$51,400 USD)

Financing:

No finance

Agreed Nightly Rent:

81,000 yen (~$520 USD)

Total Project Yield:

100% (calculated as: annual rent ÷ total project cost, including renovation and all other costs).

Sangenjaya House

Owner: Me

Location:

Setagaya, Tokyo

Purchase Price:

8 million yen (~$51,400 USD)

Renovation Cost:

8 million yen (~$51,400 USD)

Financing:

No finance

Agreed Nightly Rent:

81,000 yen (~$520 USD)

Total Project Yield:

100% (calculated as: annual rent ÷ total project cost, including renovation and all other costs).

Tsubame House

Owner: Shotaro & Ryoya

Location:

Tsubame City, Niigata Prefecture

Purchase Price:

1.6 million yen (~$10,600 USD)

Renovation Cost:

1.65 million yen (~$10,930 USD)

Financing:

4.5 million yen (Japan Finance Corporation, 10 years, 1.3% interest rate)

Agreed Monthly Rent:

72,000 yen (~$462 USD)

Total Project Yield:

26.2% (calculated as: annual rent ÷ total project cost, including renovation and all other costs).

Tsubame House

Owner: Shotaro & Ryoya

Location:

Tsubame City, Niigata Prefecture

Purchase Price:

1.6 million yen (~$10,600 USD)

Renovation Cost:

1.65 million yen (~$10,930 USD)

Financing:

4.5 million yen (Japan Finance Corporation, 10 years, 1.3% interest rate)

Agreed Monthly Rent:

72,000 yen (~$462 USD)

Total Project Yield:

26.2% (calculated as: annual rent ÷ total project cost, including renovation and all other costs).

Yaizu House

Owner: Shotaro & Ryoya

Location:

Yaizu City, Shizuoka Prefecture

Purchase Price:

2 million yen (~$13,250 USD)

Renovation Cost:

750,000 yen (~$4,970 USD)

Financing:

3.6 million yen (Japan Finance Corporation, 10 years, 1.45% interest rate)

Agreed Monthly Rent:

60,000 yen (~$385 USD)

Total Project Yield:

23.6% (calculated as: annual rent ÷ total project cost, including renovation and all other costs).

Yaizu House

Owner: Shotaro & Ryoya

Location:

Yaizu City, Shizuoka Prefecture

Purchase Price:

2 million yen (~$13,250 USD)

Renovation Cost:

750,000 yen (~$4,970 USD)

Financing:

3.6 million yen (Japan Finance Corporation, 10 years, 1.45% interest rate)

Agreed Monthly Rent:

60,000 yen (~$385 USD)

Total Project Yield:

23.6% (calculated as: annual rent ÷ total project cost, including renovation and all other costs).

Join a highly-engaged community of investors, builders, and operators. Participate in daily discussions, and leverage shared resources to accelerate your learning and achieve your investment goals.

Introducing

Cheap Houses In Japan:

The Akiya Masterclass Community.

You’ll get 3 months of free access to a powerful network of brokers, lenders, visa experts, general contractors, architects, Japanese language teachers, and fellow akiya investors.

That's not all!

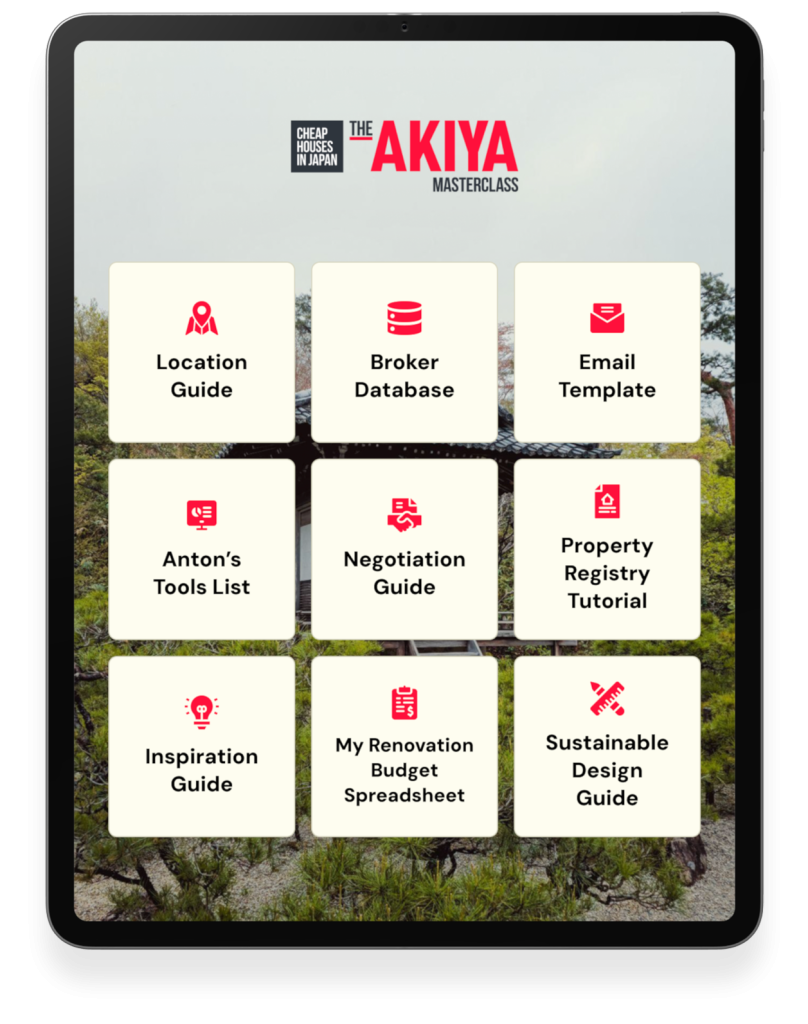

When you enroll, you'll also get access to:

And many more...

LOCATION GUIDE:

The best off-the-radar akiya investment locations in Japan.

BROKER DATABASE:

A list of well-regarded real estate brokers and agents in my favorite cities for akiya investment.

EMAIL TEMPLATE:

Copy-and-paste templates for polite and effective communication with Japanese real estate agents and municipality workers, adhering to cultural formalities that Google Translate & ChatGPT won’t insert.

ANTON'S TOOLS LIST:

A list of the online tools I use in my ongoing akiya search, and a description of how I use each.

NEGOTIATION GUIDE:

Purchase strategies specific to Japan I use to get the best prices.

PROPERTY REGISTRY TUTORIAL:

How to access the Japanese property registry.

INSPIRATION GUIDE:

Design ideas to adapt akiyas to modern styles while preserving traditional elements.

MY RENOVATION BUDGET SPREADSHEET:

Template for planning renovation costs, including trash disposal, materials, and labor.

SUSTAINABLE DESIGN GUIDE:

My guide for finding excellent-condition used building materials, furniture & appliances throughout Japan at low prices.

This is for you if:

- You’re ready to build a lucrative, beautiful real estate portfolio in Japan.

- You crave financial freedom and the flexibility to travel the world while your properties generate passive income.

- You want to learn the insider secrets to finding, acquiring, and renovating cheap houses in Japan that consistently attract high-paying short-term and long-term tenants.

This is for you if:

- You’re ready to build a lucrative, beautiful real estate portfolio in Japan.

- You crave financial freedom and the flexibility to travel the world while your properties generate passive income.

- You want to learn the insider secrets to finding, acquiring, and renovating cheap houses in Japan that consistently attract high-paying short-term and long-term tenants.

Frequently Asked Questions

How long is the course?

The Cheap Houses in Japan – The Akiya Masterclass comes with 7 in-depth video lessons that will equip you to find, buy and renovate your akiya + a bonus Choosing The Right Visa lesson (~100 minutes of content) + 6 detailed tasks that’ll guide you through the process of finding and buying your first akiya.

Is the course self-paced?

Yes! Once you purchase the masterclass, you’ll have the opportunity to dive in to the lessons immediately and can progress at your own pace.

If I’m not able to enroll now, will this be available in the future?

Yes, but prices will increase as my expansion modules & materials are added (you will have lifetime free access to all expansion modules, materials & tools).

Can anyone buy an akiya regardless of nationality?

No matter which country you’re from, you have the right to buy, own and transfer property with the same rights and low property taxes as local Japanese citizens.

How long do I have access to the course?

Lifetime access. Once you purchase the course you can go back and re-watch it as many times as you like! You’ll also get my upcoming expansion courses for FREE, and will retain access to all the course videos and materials permanently!

Do I need to buy anything extra once I purchase?

No! Everything included inside requires no extra purchases. Certain tools included at no cost now will require additional purchases by future enrollees.

Do I need a real estate background to buy an akiya?

No, you don’t need a real estate background to buy an akiya in Japan! Akiyas (abandoned homes) are often sold at low prices, and the process is accessible to beginners.

Masterclass Content:

Unlimited access to the 8 masterclass videos (7 chapters + 1 bonus Visas For Investors chapter)!

$900

3 Month Access To The Community:

Access to our highly-engaged community of fellow akiya investors, Japan-based real estate brokers, transaction specialists, visa experts, Japan-based lenders, general contractors, insurance brokers and more! Ask questions, share ideas and experiences, and get expert feedback!

(Limited to first 250 Akiya Program members)*

$594

Anton’s Downloadable Tools:

Access 15 downloads with essential information and valuable functions to accelerate your akiya purchase and help you earn more profit!

$1,500

Total value if purchased separately: $2,994

Total if you purchase all of this together: $470 (First 250 Members Only)*